2018 Form 940

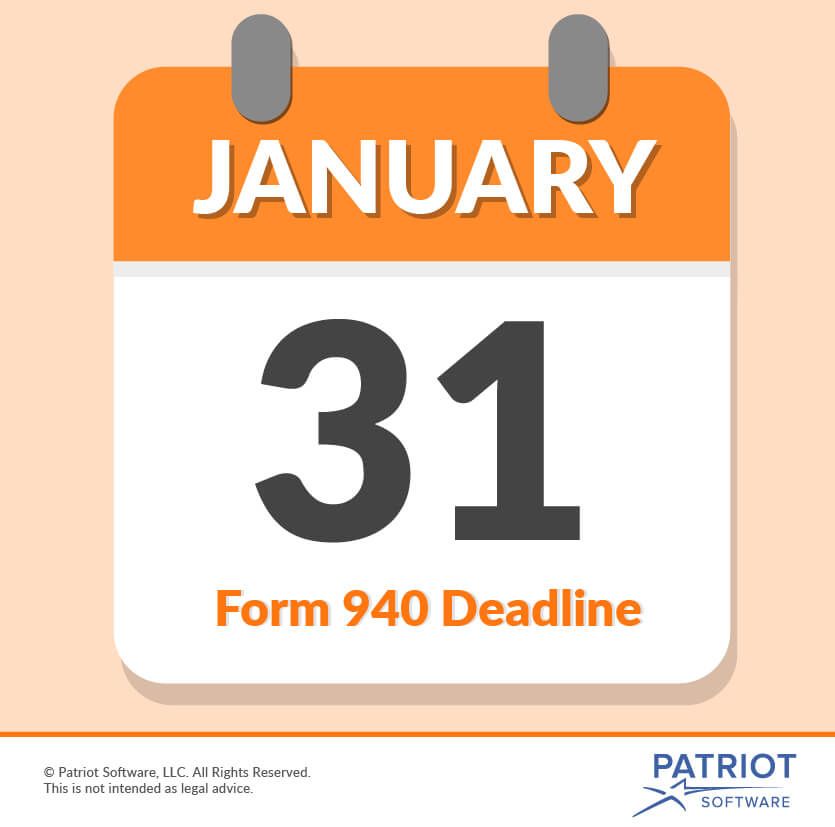

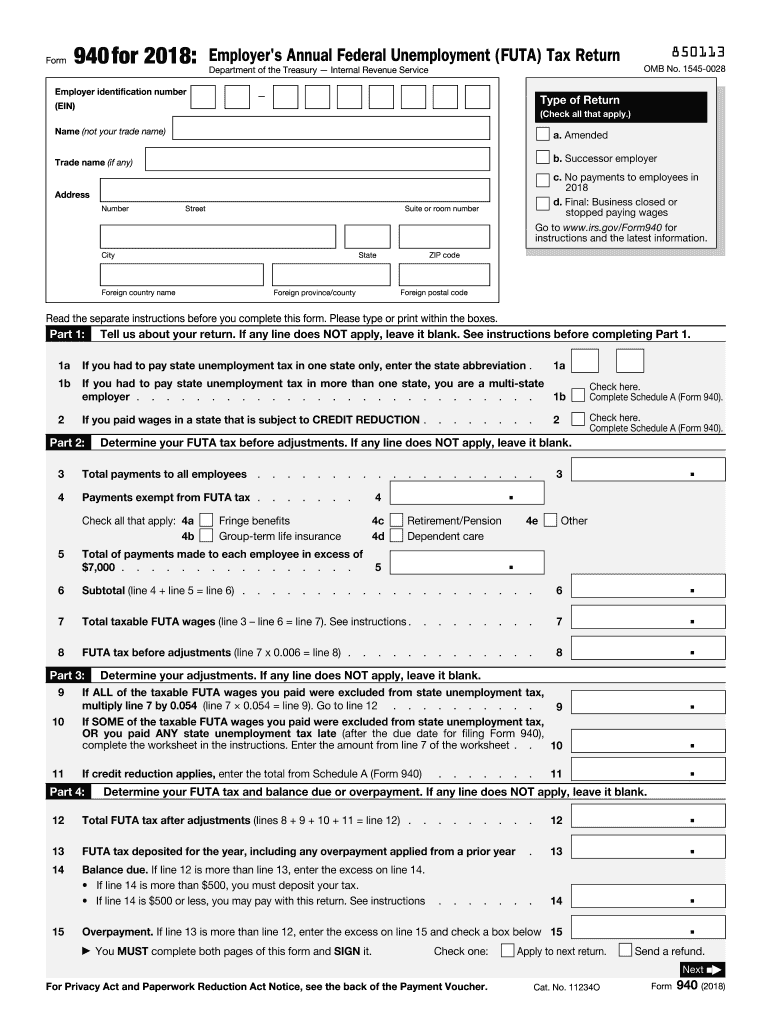

2018 Form 940 - Web the form 940 for 2018 employer's annual federal unemployment tax return form is 3 pages long and contains: Web schedule a (form 940) for 2018: Employer identification number (ein) — name (not. Form 940 is due on jan. Future developments for the latest information about developments related to form 940 and its instructions, such as. The form is due january 31, or february 10 for businesses that have already deposited their unemployment taxes in full. The schedule, which is used to report additional tax owed because of federal unemployment. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. Use form 940 to report your annual federal unemployment tax act (futa) tax. File this schedule with form 940.

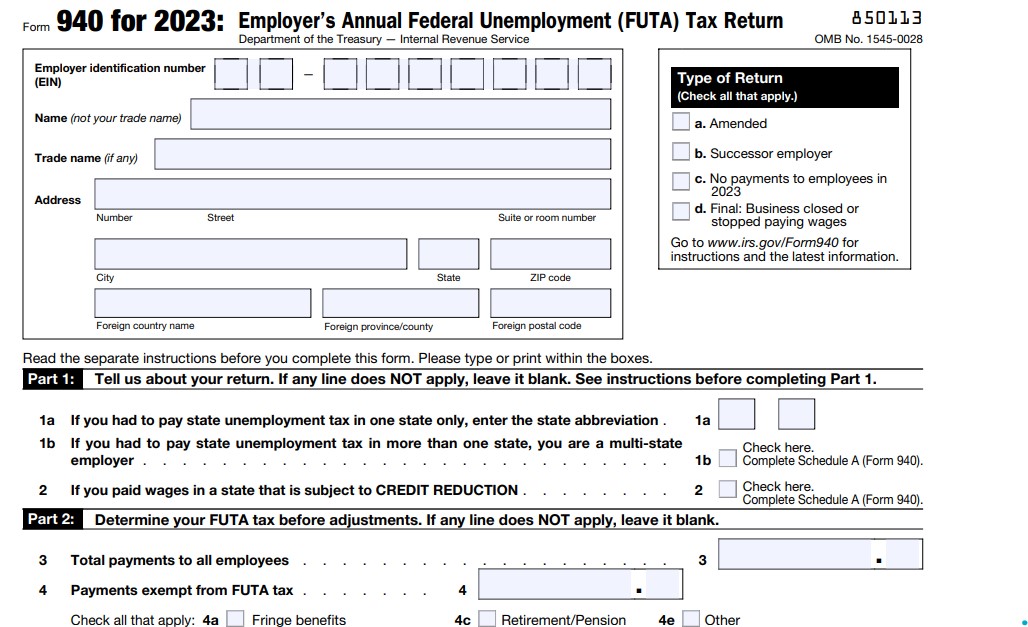

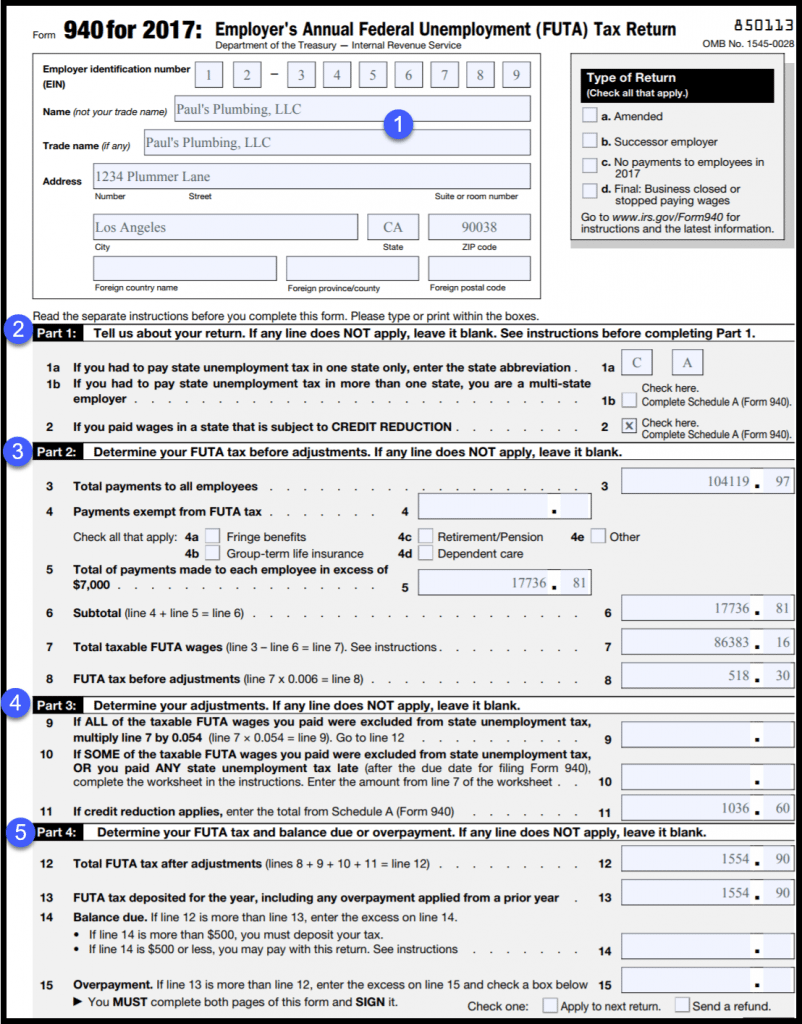

Web 2018 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Use form 940 to report your annual federal unemployment tax act (futa) tax. Future developments for the latest information about developments related to form 940 and its instructions, such as. Paid preparers must sign paper returns with a manual signature. Employer identification number (ein) — name (not. Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Instructions for form 940 (2020) pdf. Web the form 940 for 2018 employer's annual federal unemployment tax return form is 3 pages long and contains: The form is due january 31, or february 10 for businesses that have already deposited their unemployment taxes in full. Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service.

The schedule, which is used to report additional tax owed because of federal unemployment. Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Web schedule a (form 940) for 2018: Businesses with employees are responsible for paying. Web the 2018 form 940, employer’s annual federal unemployment (futa) tax return, was released nov. Employer identification number (ein) — name (not. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. 31 each year for the previous year. The form is due january 31, or february 10 for businesses that have already deposited their unemployment taxes in full. Future developments for the latest information about developments related to form 940 and its instructions, such as.

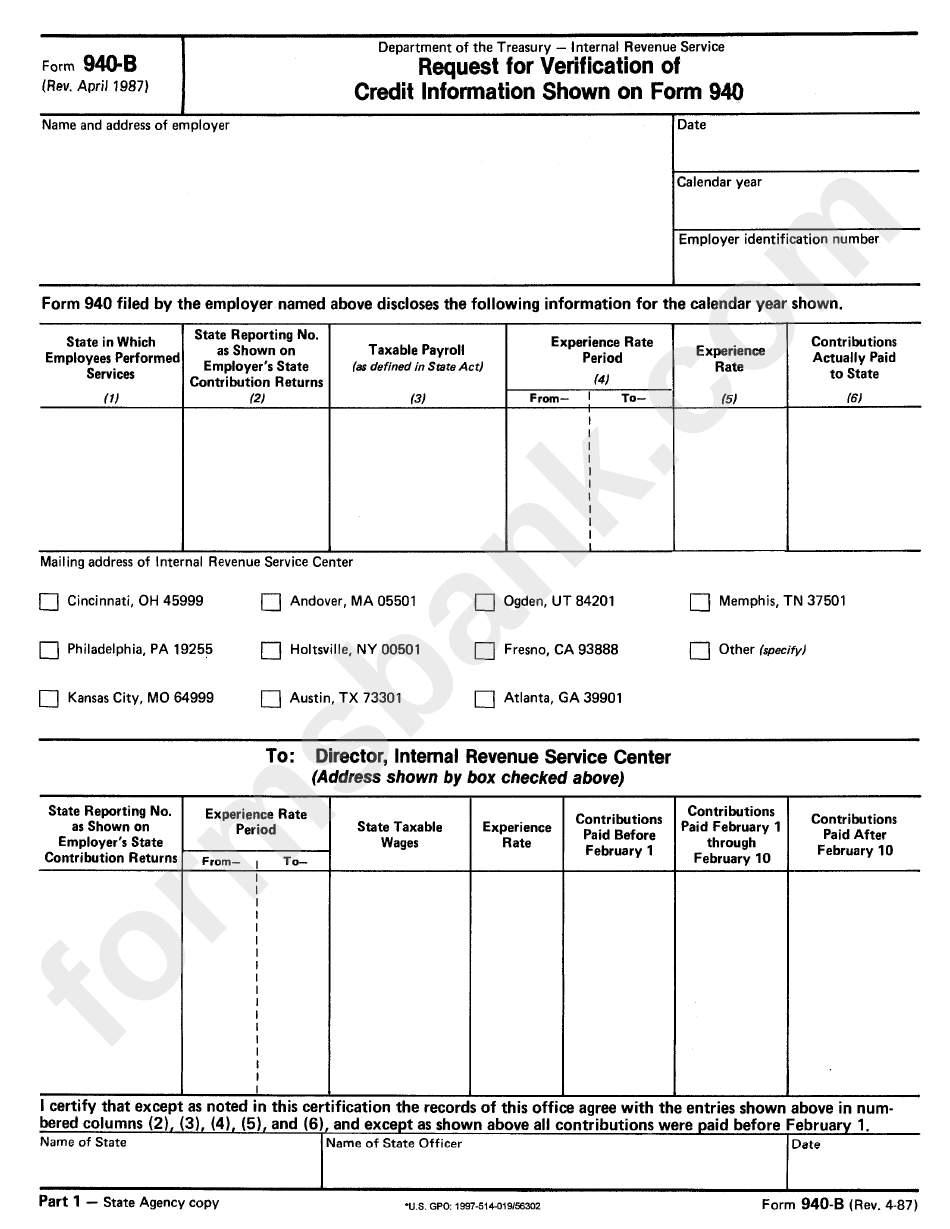

Form 940B Request For Verification Of Credit Information Shown On

File this schedule with form 940. Pdf use our library of forms to. Paid preparers must sign paper returns with a manual signature. Form 940 is due on jan. Web the form 940 for 2018 employer's annual federal unemployment tax return form is 3 pages long and contains:

File 940 Online EFile 940 for 4.95 FUTA Form 940 for 2022

Pdf use our library of forms to. File this schedule with form 940. Future developments for the latest information about developments related to form 940 and its instructions, such as. Paid preparers must sign paper returns with a manual signature. 21 by the internal revenue service.

Fill Free fillable form 940 for 2018 employer's annual federal

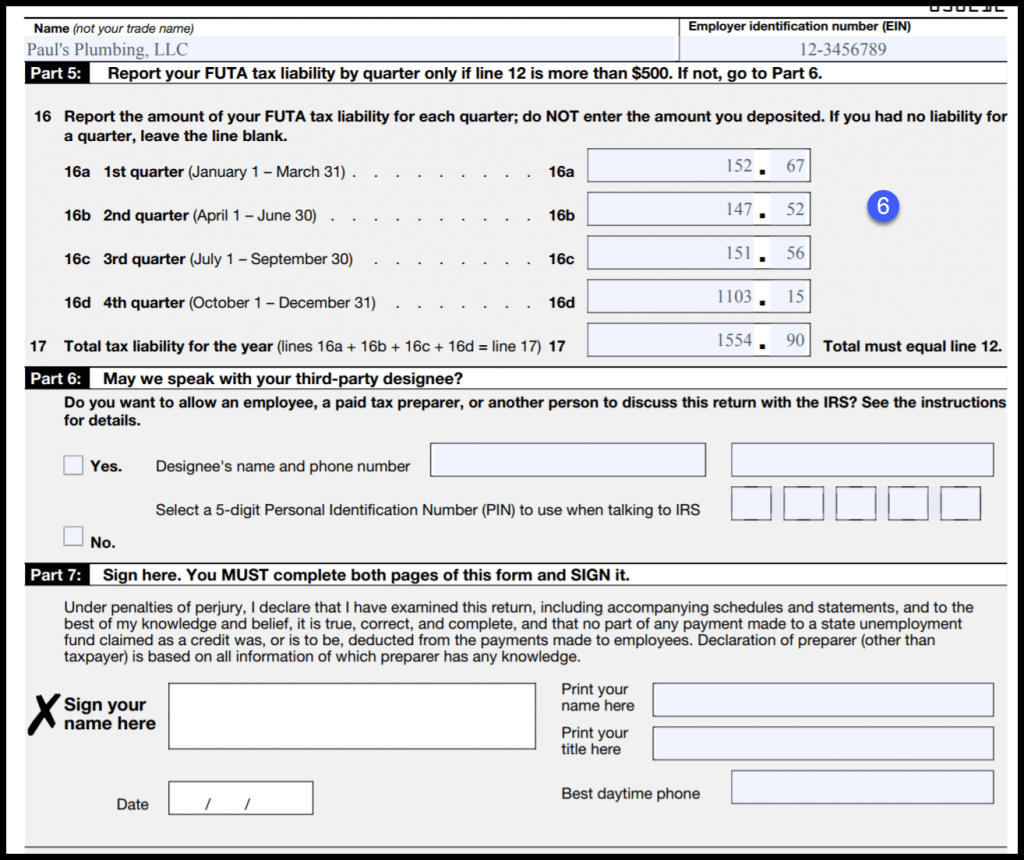

Businesses with employees are responsible for paying. Paid preparers must sign paper returns with a manual signature. Web form 940 shows the amount of federal unemployment taxes the employer owed the previous year, how much has already been paid, and the outstanding balance. Web the form 940 for 2018 employer's annual federal unemployment tax return form is 3 pages long.

Form 940 YouTube

Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service. Form 940 is due on jan. Future developments for the latest information about developments related to form 940 and its instructions, such as. 21 by the internal revenue service. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to.

Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return

Employer identification number (ein) — name (not. Web the 2018 form 940, employer’s annual federal unemployment (futa) tax return, was released nov. Future developments for the latest information about developments related to form 940 and its instructions, such as. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. 31 each.

When Are Payroll Taxes Due? Federal Deadlines

Future developments for the latest information about developments related to form 940 and its instructions, such as. Instructions for form 940 (2020) pdf. Web the form 940 for 2018 employer's annual federal unemployment tax return form is 3 pages long and contains: Web form 940 shows the amount of federal unemployment taxes the employer owed the previous year, how much.

2018 FUTA Tax Rate & Form 940 Instructions

Web form 940 for 2018: Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. Form 940 is due on jan. Use form 940 to report your annual federal unemployment tax act (futa) tax. Employer identification number (ein) — name (not.

File 940 Online Efile FUTA Tax IRS Form 940 for 2018

Web a paid preparer must sign form 940 and provide the information in the paid preparer use only section of part 7 if the preparer was paid to prepare form 940 and isn't an employee of the filing entity. Web form 940 for 2018: Web 2018 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the.

2018 FUTA Tax Rate & Form 940 Instructions

21 by the internal revenue service. Pdf use our library of forms to. Use form 940 to report your annual federal unemployment tax act (futa) tax. Web 2018 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Together with state.

Form 940 For 2018 Fill Out and Sign Printable PDF Template signNow

Web the form 940 for 2018 employer's annual federal unemployment tax return form is 3 pages long and contains: Web 2018 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web schedule a (form 940) for 2018: Instructions for form.

Future Developments For The Latest Information About Developments Related To Form 940 And Its Instructions, Such As.

Web the 2018 form 940, employer’s annual federal unemployment (futa) tax return, was released nov. The form is due january 31, or february 10 for businesses that have already deposited their unemployment taxes in full. Instructions for form 940 (2020) pdf. 31 each year for the previous year.

21 By The Internal Revenue Service.

Form 940 is due on jan. Web form 940 shows the amount of federal unemployment taxes the employer owed the previous year, how much has already been paid, and the outstanding balance. Pdf use our library of forms to. The schedule, which is used to report additional tax owed because of federal unemployment.

Web Form 940 (2020) Employer's Annual Federal Unemployment (Futa) Tax Return.

Use form 940 to report your annual federal unemployment tax act (futa) tax. Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service. File this schedule with form 940. Web a paid preparer must sign form 940 and provide the information in the paid preparer use only section of part 7 if the preparer was paid to prepare form 940 and isn't an employee of the filing entity.

Web 2018 Instructions For Form 940 Employer's Annual Federal Unemployment (Futa) Tax Return Department Of The Treasury Internal Revenue Service Section References Are To The Internal Revenue Code Unless Otherwise Noted.

Paid preparers must sign paper returns with a manual signature. Web form 940 for 2018: Employer identification number (ein) — name (not. Businesses with employees are responsible for paying.