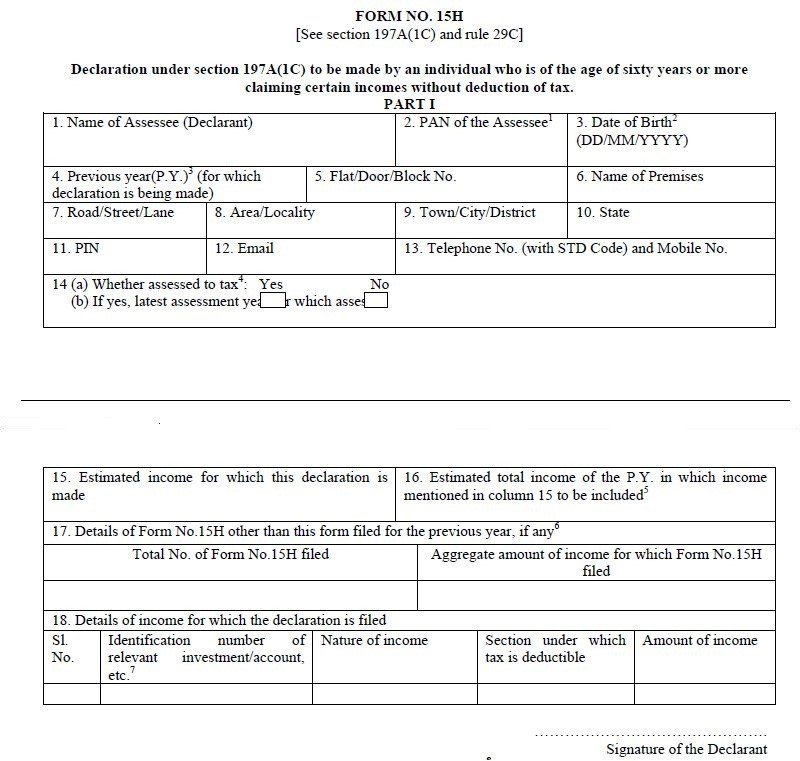

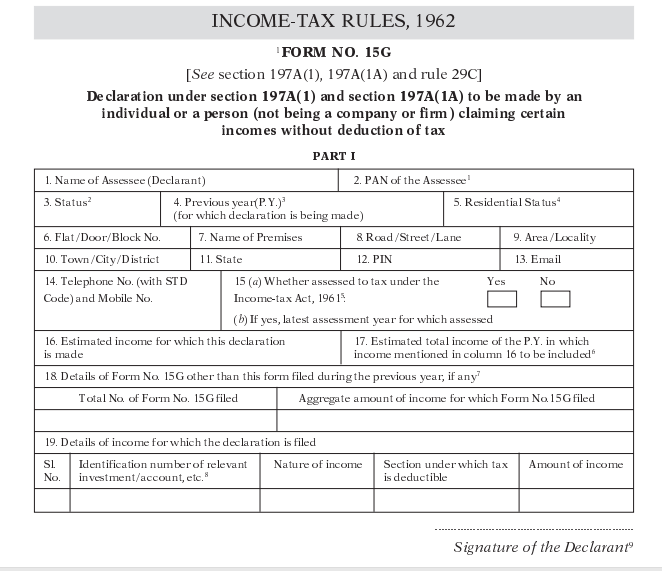

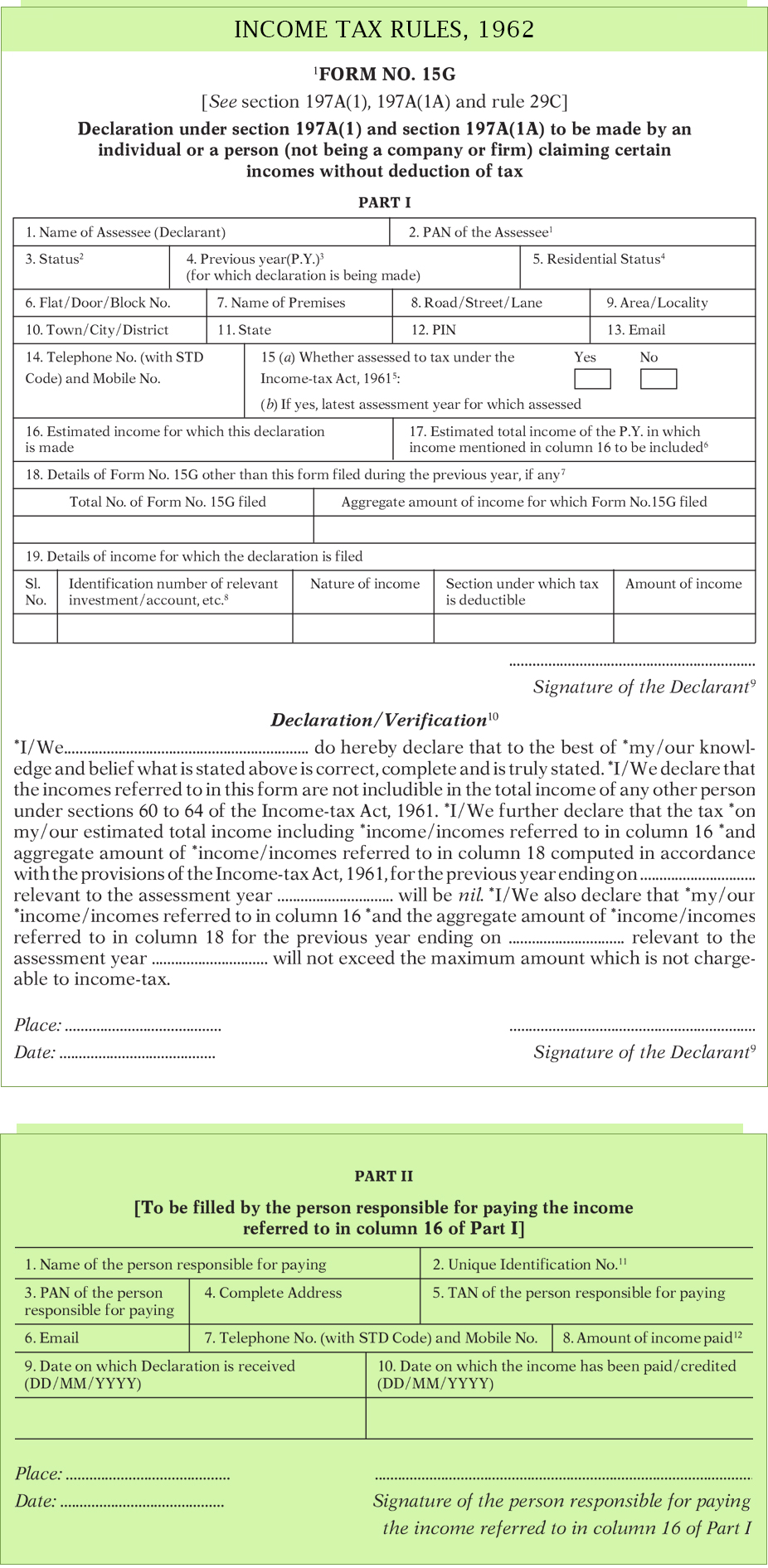

15G Or 15H Form

15G Or 15H Form - Web purpose to fill form 15g and 15h. Household employee cash wages of $1,900. Web calendar year taxpayers having no household employees in 2015 do not have to complete this form for 2015. You should be aged 60 years or above to use form 15h. Form 15g/ 15h is used to make sure that tds is not deducted from your income if you meet certain conditions as mentioned below. Web form 15g and form 15h are the documents that you can submit to make sure tds is not deducted from your income. Web however, no tax or reduced tax shall be deducted on the dividend payable by the company in cases the shareholder provides form 15g (applicable to any resident individual other. If you are an nri, you are not eligible to submit these forms. Therefore, you must submit the forms at the start of every financial year to ensure that. Web you can submit forms 15g and 15h to avoid tds deduction on your interest income in such a case.

You should be aged 60 years or above to use form 15h. Web individuals with total income below the tax limit can save tds on interest by submitting form 15g or form 15h. Household employee cash wages of $1,900. Hindu undivided families can also use. You should be aged below 60 years to use form 15g. Web form 15g and 15h are both valid only for the current financial year. Web calendar year taxpayers having no household employees in 2015 do not have to complete this form for 2015. Web however, no tax or reduced tax shall be deducted on the dividend payable by the company in cases the shareholder provides form 15g (applicable to any resident individual other. Web you can submit forms 15g and 15h to avoid tds deduction on your interest income in such a case. You must have a pan to furnish these.

Web form 15g and 15h are both valid only for the current financial year. Web since you have submitted the 15g form they would not deduct tds. Household employee cash wages of $1,900. Form 15g/ 15h is used to make sure that tds is not deducted from your income if you meet certain conditions as mentioned below. You should be aged below 60 years to use form 15g. Web purpose to fill form 15g and 15h. Hindu undivided families can also use. Therefore, you must submit the forms at the start of every financial year to ensure that. Web individuals with total income below the tax limit can save tds on interest by submitting form 15g or form 15h. You should be aged 60 years or above to use form 15h.

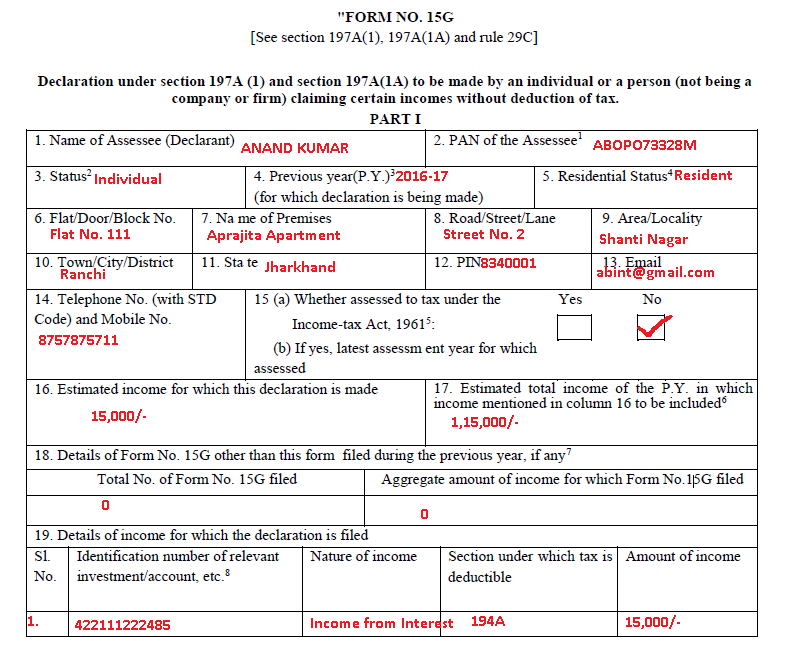

How To Fill Form 15G And 15H ★ Filled Form 15G Sample ★ Form 15H Sample

Form 15g is a declaration that can be filled out by fixed deposit holders. You should be aged 60 years or above to use form 15h. Therefore, you must submit the forms at the start of every financial year to ensure that. Household employee cash wages of $1,900. Hindu undivided families can also use.

How To Fill New Form 15G / Form 15H roy's Finance

Banks deduct tds on interest income when the limit crosses. Web since you have submitted the 15g form they would not deduct tds. Web however, no tax or reduced tax shall be deducted on the dividend payable by the company in cases the shareholder provides form 15g (applicable to any resident individual other. Validity of 15g and 15h is one.

Form 15G & 15H What is Form 15G? How to Fill Form 15G for PF Withdrawal

Therefore, you must submit the forms at the start of every financial year to ensure that. Web since you have submitted the 15g form they would not deduct tds. Web form 15g and 15h are both valid only for the current financial year. Validity of 15g and 15h is one year only and needs to be submitted every. Web here.

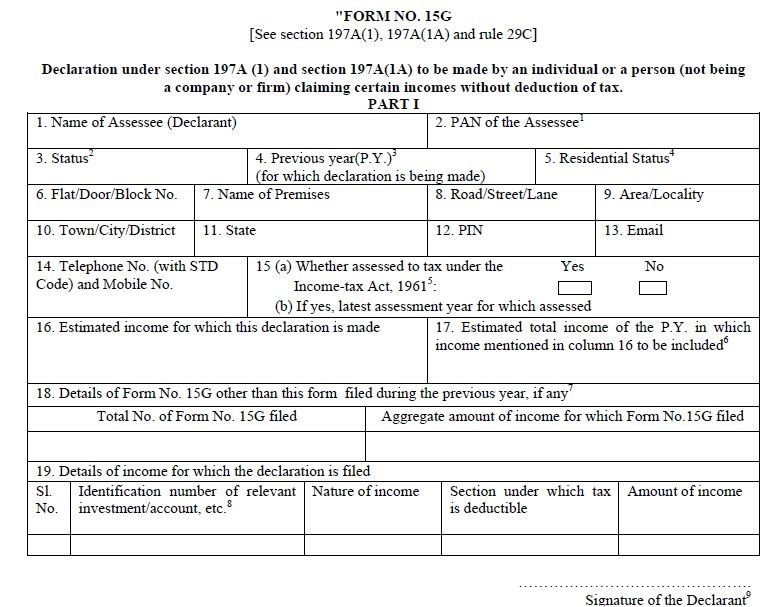

15h Form Fill Online, Printable, Fillable, Blank pdfFiller

Hindu undivided families can also use. Web since you have submitted the 15g form they would not deduct tds. Web here are the most important things to know about form 15g and form 15h declaration: Web what is form 15g/15h? You should be aged below 60 years to use form 15g.

EVERYTHING BANKING NEWS 15G 15H Form Fill Up Step wise Guideline with

Web what is form 15g/15h? Banks deduct tds on interest income when the limit crosses. Hindu undivided families can also use. Household employee cash wages of $1,900. You should be aged 60 years or above to use form 15h.

New Form 15G & Form 15H New format & procedure

Web what is form 15g/15h? Web you can submit forms 15g and 15h to avoid tds deduction on your interest income in such a case. Web purpose to fill form 15g and 15h. Web here are the most important things to know about form 15g and form 15h declaration: Web form 15g and 15h are both valid only for the.

How To Fill New Form 15G / Form 15H roy's Finance

Web since you have submitted the 15g form they would not deduct tds. Household employee cash wages of $1,900. Form 15g is a declaration that can be filled out by fixed deposit holders. Web home investments tds on fixed deposit tds on fd interest know all the details about tds on fd interest and download form 15g and form 15h.

Form 15H (Save TDS on Interest How to Fill & Download

Web since you have submitted the 15g form they would not deduct tds. Web form 15h is for resident indians aged 60 years or above. Form 15g is a declaration that can be filled out by fixed deposit holders. Web form 15g and 15h are both valid only for the current financial year. Hindu undivided families can also use.

Are You Eligible To Furnish Form 15G / 15H? The Wealth Architects

Web form 15h is for resident indians aged 60 years or above. Form 15g is a declaration that can be filled out by fixed deposit holders. You should be aged below 60 years to use form 15g. Validity of 15g and 15h is one year only and needs to be submitted every. Web what is form 15g/15h?

Breanna Withdrawal Form 15g Part 2 Filled Sample

Banks deduct tds on interest income when the limit crosses. Web form 15h is for resident indians aged 60 years or above. Form 15g/ 15h is used to make sure that tds is not deducted from your income if you meet certain conditions as mentioned below. Validity of 15g and 15h is one year only and needs to be submitted.

Web Individuals With Total Income Below The Tax Limit Can Save Tds On Interest By Submitting Form 15G Or Form 15H.

Web you can submit forms 15g and 15h to avoid tds deduction on your interest income in such a case. Web what is form 15g/15h? Form 15g is a declaration that can be filled out by fixed deposit holders. You should be aged 60 years or above to use form 15h.

Web Form 15H Is For Resident Indians Aged 60 Years Or Above.

Hindu undivided families can also use. Web purpose to fill form 15g and 15h. You should be aged below 60 years to use form 15g. Web form 15g and 15h are both valid only for the current financial year.

If You Are An Nri, You Are Not Eligible To Submit These Forms.

Web home investments tds on fixed deposit tds on fd interest know all the details about tds on fd interest and download form 15g and form 15h to save your. Web here are the most important things to know about form 15g and form 15h declaration: Banks deduct tds on interest income when the limit crosses. Household employee cash wages of $1,900.

Web Calendar Year Taxpayers Having No Household Employees In 2015 Do Not Have To Complete This Form For 2015.

Validity of 15g and 15h is one year only and needs to be submitted every. Web since you have submitted the 15g form they would not deduct tds. Form 15g/ 15h is used to make sure that tds is not deducted from your income if you meet certain conditions as mentioned below. Web however, no tax or reduced tax shall be deducted on the dividend payable by the company in cases the shareholder provides form 15g (applicable to any resident individual other.