1099 Form Ct

1099 Form Ct - Web while electronic versions of the 1099g tax forms can immediately be downloaded online, the labor department can mail a copy to claimants requesting one through the online 1099g. Web what types of 1099 forms does connecticut require? Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in connecticut during calendar year 2023. Notifications will also be immediately sent to the 2,556. Staples provides custom solutions to help organizations achieve their goals. Web 1099r's for 2021 distributions out of the teachers' retirement system will be mailed by january 31st, 2022. Ad don't just get the job done, get the job done right at staples®. Please allow up to 14 days for it to be received. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web the publication includes that:

Web while electronic versions of the 1099g tax forms can immediately be downloaded online, the labor department can mail a copy to claimants requesting one through the online 1099g. Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Notifications will also be immediately sent to the 2,556. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. The gross connecticut nonpayroll amounts reported on form ct‑945 or form ct‑941x, line 2, must agree with total nonpayroll. 1999 amended income tax return for individuals. Web the publication includes that: Web what types of 1099 forms does connecticut require? Web expenditure section forms 1099 and special compensation 8.0 federal income tax reporting, form 1099 the comptroller's office will report the following types of.

Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. 2) the due date for filing. Web 1099r's for 2021 distributions out of the teachers' retirement system will be mailed by january 31st, 2022. Notifications will also be immediately sent to the 2,556. Staples provides custom solutions to help organizations achieve their goals. For internal revenue service center. Ad don't just get the job done, get the job done right at staples®. Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services. Please allow up to 14 days for it to be received. Web while electronic versions of the 1099g tax forms can immediately be downloaded online, the labor department can mail a copy to claimants requesting one through the online 1099g.

Form1099NEC

2) the due date for filing. Web what types of 1099 forms does connecticut require? Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services. How must forms 1099 be filed with. Web while electronic versions of the 1099g tax forms can immediately be downloaded online, the labor department can mail a.

IRS Form 1099 Reporting for Small Business Owners Best Practice in HR

How must forms 1099 be filed with. Web the publication includes that: Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. The gross connecticut nonpayroll amounts reported on form ct‑945 or form ct‑941x, line 2, must agree with total nonpayroll. Web expenditure section forms 1099 and special compensation 8.0 federal income tax reporting,.

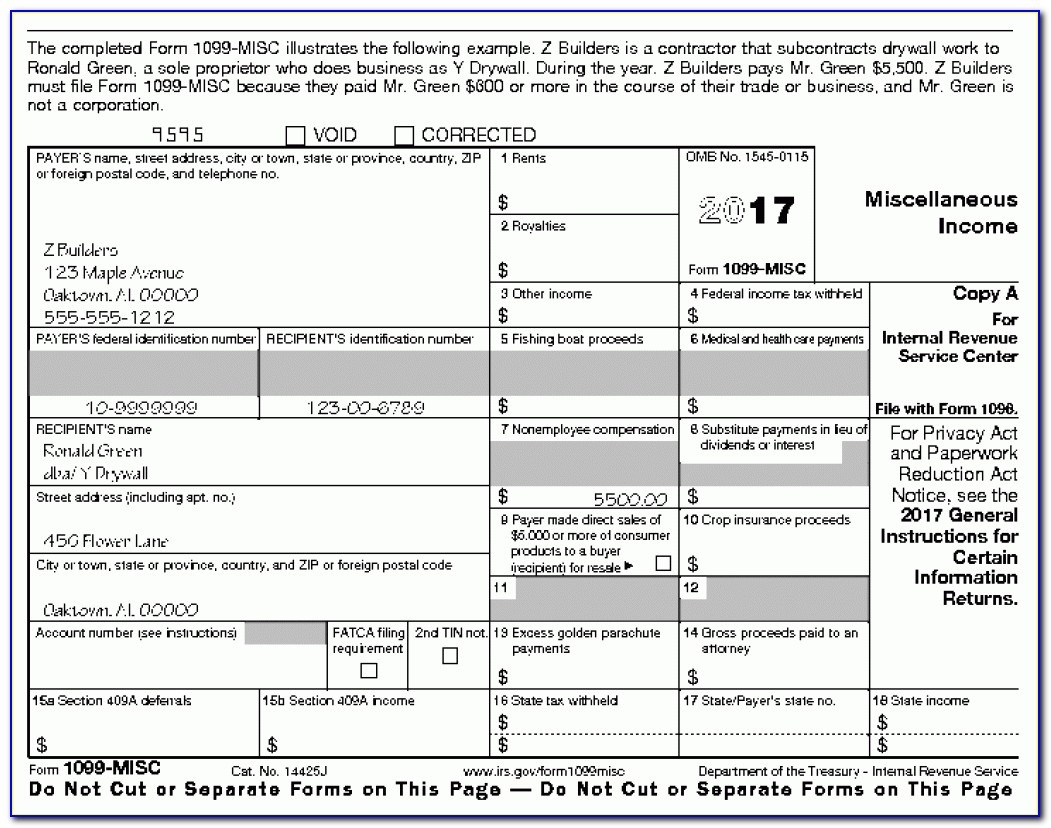

What is a 1099Misc Form? Financial Strategy Center

Ad don't just get the job done, get the job done right at staples®. How must forms 1099 be filed with. Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services. Please allow up to 14 days for it to be received. Ap leaders rely on iofm’s expertise to keep them up.

What is a 1099 & 5498? uDirect IRA Services, LLC

How must forms 1099 be filed with. Notifications will also be immediately sent to the 2,556. Web what types of 1099 forms does connecticut require? Web while electronic versions of the 1099g tax forms can immediately be downloaded online, the labor department can mail a copy to claimants requesting one through the online 1099g. Please allow up to 14 days.

Form 1099INT Interest Definition

1999 amended income tax return for individuals. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services. Ad don't just get the job done, get the job done right at staples®. Web these where to file.

11 Common Misconceptions About Irs Form 11 Form Information Free

Web while electronic versions of the 1099g tax forms can immediately be downloaded online, the labor department can mail a copy to claimants requesting one through the online 1099g. Web what types of 1099 forms does connecticut require? Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in.

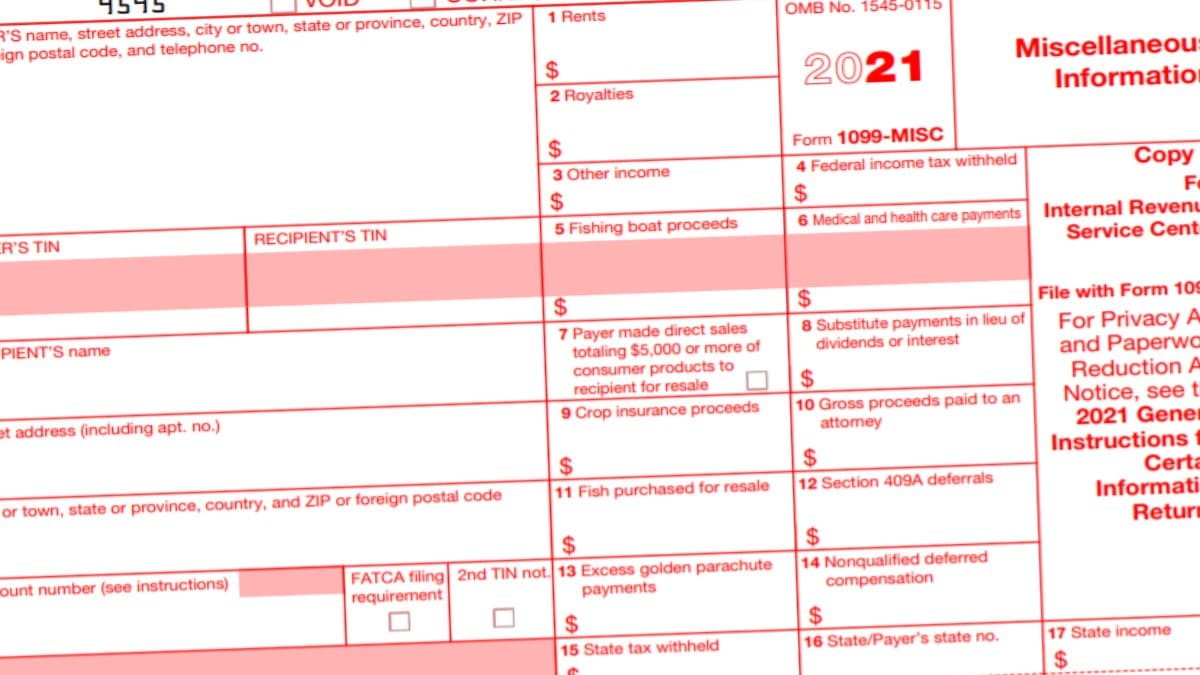

1099 MISC Form 2022 1099 Forms TaxUni

Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in connecticut during calendar year 2023. 2) the due date for filing. Staples provides custom solutions to help organizations achieve their goals. How must forms 1099 be filed with. Web the publication includes that:

How to Calculate Taxable Amount on a 1099R for Life Insurance

Staples provides custom solutions to help organizations achieve their goals. Web expenditure section forms 1099 and special compensation 8.0 federal income tax reporting, form 1099 the comptroller's office will report the following types of. 2) the due date for filing. Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services. 1999 amended.

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

1999 amended income tax return for individuals. Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services. Staples provides custom solutions to help organizations achieve their goals. Web 1099r's for 2021 distributions out of the teachers' retirement system will be mailed by january 31st, 2022. Web while electronic versions of the 1099g.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

For internal revenue service center. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in connecticut during calendar year 2023. Ad don't just get the job done, get the job done right at staples®. Web the publication includes that: Staples provides custom solutions to help organizations achieve their.

Notifications Will Also Be Immediately Sent To The 2,556.

Staples provides custom solutions to help organizations achieve their goals. Please allow up to 14 days for it to be received. For internal revenue service center. Ad don't just get the job done, get the job done right at staples®.

2) The Due Date For Filing.

How must forms 1099 be filed with. The gross connecticut nonpayroll amounts reported on form ct‑945 or form ct‑941x, line 2, must agree with total nonpayroll. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in connecticut during calendar year 2023. Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services.

Web What Types Of 1099 Forms Does Connecticut Require?

Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web expenditure section forms 1099 and special compensation 8.0 federal income tax reporting, form 1099 the comptroller's office will report the following types of. 1999 amended income tax return for individuals.

Web While Electronic Versions Of The 1099G Tax Forms Can Immediately Be Downloaded Online, The Labor Department Can Mail A Copy To Claimants Requesting One Through The Online 1099G.

Web the publication includes that: Web 1099r's for 2021 distributions out of the teachers' retirement system will be mailed by january 31st, 2022.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)