What Happens If I Don't File Form 8843

What Happens If I Don't File Form 8843 - Web do not use tax filing programs (such as sprintax) to fill out the form 8843. Is my tuition scholarship considered taxable income? You do not need a social security. You should file the previous year's. Web the irs may impose penalties for both failure to file and failure to pay, which can result in a 5% penalty for each month that your return is late. Web if you do not file form 8843 on time, you may not exclude the days you were present in the united states as a professional athlete or because of a medical condition or. Web what happens if i don’t send in form 8843? Web the penalty maxes out at 25% of your taxes due. You do not need to complete a state income tax return. Web there are several ways to submit form 4868.

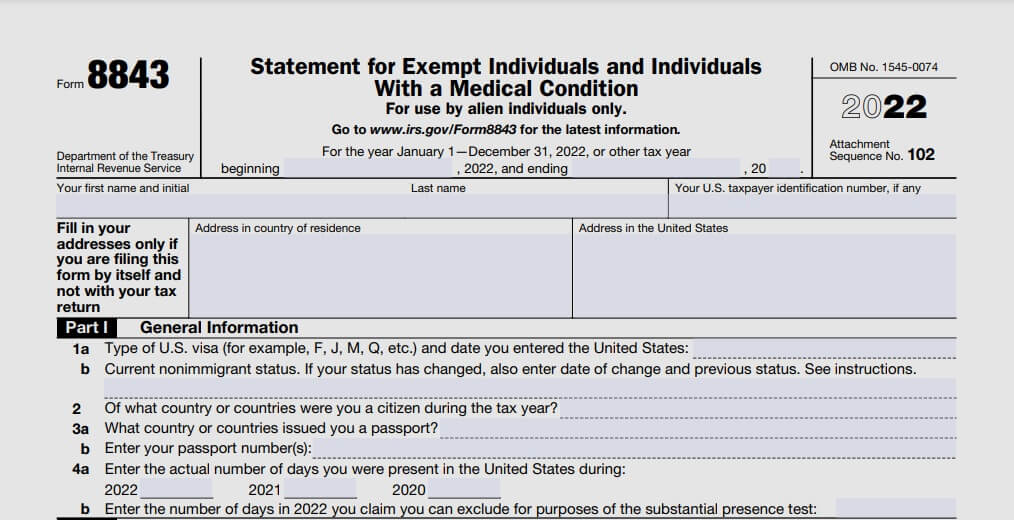

Generally, students who have been in the. You do not need to complete a state income tax return. Web what if form 8843 is not filed? Web penalty for not filing form 8843 if you don’t file form 8843 on time, you may not exclude the days you were present in the united states as a professional athlete or because of a. Web if you do not file form 8843 on time, you may not exclude the days you were present in the united states as a professional athlete or because of a medical condition or. Web the irs may impose penalties for both failure to file and failure to pay, which can result in a 5% penalty for each month that your return is late. Web what if i forgot to file my form 8843 in a previous year? The general answer is no. Web if you are an alien individual, file form 8843 to explain the basis of your claim that you can exclude days present in the united states for purposes of the substantial presence test. You should file the previous year's.

Web yes yes no no for paperwork reduction act notice, see instructions. Web do i need a social security number or individual taxpayer identification number to file form 8843? Web those considered resident alien for tax purposes including spouses and dependents, do not have to file the form 8843. Web penalty for not filing form 8843 if you don’t file form 8843 on time, you may not exclude the days you were present in the united states as a professional athlete or because of a. Web what if form 8843 is not filed? You do not need to complete a state income tax return. If you go longer than 5. Do i have to file a tax return? Web the penalty for failing to file represents 5% of your unpaid tax liability for each month your return is late, up to 25% of your total unpaid taxes. If you don’t file form 8843 on time, you may not exclude the days you were present in the united states as a professional.

Form 8843 Instructions How to fill out 8843 form online & file it

You do not need to complete a state income tax return. Web those considered resident alien for tax purposes including spouses and dependents, do not have to file the form 8843. Web what happens if i don’t send in form 8843? Web what if i forgot to file my form 8843 in a previous year? Web what if form 8843.

[2016 버전] 미국 유학생 텍스 리턴 3편 (Form 8843 작성법) Bluemoneyzone

Web on f1 you do not count days towards the substantial presence test for the first 5 calendar years, so from 2013 to 2017. You should file the previous year's. If you don’t file form 8843 on time, you may not exclude the days you were present in the united states as a professional. Taxpayers can file form 4868 by.

What is Form 8843 and How Do I File it? Sprintax Blog

Web on f1 you do not count days towards the substantial presence test for the first 5 calendar years, so from 2013 to 2017. Web my only income was some bank interest. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web penalty for not filing form 8843 if you.

Form 8843 Statement for Exempt Individuals and Individuals with a

Web on f1 you do not count days towards the substantial presence test for the first 5 calendar years, so from 2013 to 2017. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web do i need a social security number or individual taxpayer identification number to file form 8843? However,.

What Happens When I Don't File My Annual Returns? DIYlaw Resources

Web yes yes no no for paperwork reduction act notice, see instructions. Web if you do not file form 8843 on time, you may not exclude the days you were present in the united states as a professional athlete or because of a medical condition or. If you eventually file but it’s more than 60 days after the april deadline,.

8843 Form 2021 IRS Forms Zrivo

Web if you are an alien individual, file form 8843 to explain the basis of your claim that you can exclude days present in the united states for purposes of the substantial presence test. Web the irs may impose penalties for both failure to file and failure to pay, which can result in a 5% penalty for each month that.

1+ 8843 Form Free Download

You should file the previous year's. Web do i need a social security number or individual taxpayer identification number to file form 8843? Web what if form 8843 is not filed? Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web on f1 you do not count days towards the substantial.

Close Up Of Usa Tax Form Type 8843 Statement For Exempt Individuals And

Web penalty for not filing form 8843 as provided by the irs: If you’re due a refund,. You should file the previous year's. There is no monetary penalty for not filing form 8843. Generally, students who have been in the.

Download 2012 8843 Form for Free Page 3 FormTemplate

Web on f1 you do not count days towards the substantial presence test for the first 5 calendar years, so from 2013 to 2017. Tax law is part of maintaining your immigration status. Web what if form 8843 is not filed? If you’re due a refund,. Web what if i forgot to file my form 8843 in a previous year?

What happens if I don’t file ITR?

If you eventually file but it’s more than 60 days after the april deadline, the minimum penalty is $135 or 100% of the. So for 2017 you are still a nonresident alien. Web there are several ways to submit form 4868. You should file the previous year's. The general answer is no.

Web What Happens If I Don’t Send In Form 8843?

You should file the previous year's. So for 2017 you are still a nonresident alien. Is there a minimum income threshold that. Form 8843, statement for exempt individuals and individuals claiming a medical condition is required by the regulations to be.

If You Go Longer Than 5.

Web if you are an alien individual, file form 8843 to explain the basis of your claim that you can exclude days present in the united states for purposes of the substantial presence test. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. However, days of presence that are excluded must be properly recorded by filing form. Web there are several ways to submit form 4868.

Web My Only Income Was Some Bank Interest.

Web those considered resident alien for tax purposes including spouses and dependents, do not have to file the form 8843. Web yes yes no no for paperwork reduction act notice, see instructions. Web do i need a social security number or individual taxpayer identification number to file form 8843? The general answer is no.

Web The Penalty Maxes Out At 25% Of Your Taxes Due.

Web what if i forgot to file my form 8843 in a previous year? Web if you do not file form 8843 on time, you may not exclude the days you were present in the united states as a professional athlete or because of a medical condition or. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web do not use tax filing programs (such as sprintax) to fill out the form 8843.

![[2016 버전] 미국 유학생 텍스 리턴 3편 (Form 8843 작성법) Bluemoneyzone](https://img1.daumcdn.net/thumb/R800x0/?scode=mtistory2&fname=https:%2F%2Ft1.daumcdn.net%2Fcfile%2Ftistory%2F2638E83958C218ED0B)