Crypto.com 1099 Tax Form

Crypto.com 1099 Tax Form - Web 1099 tax forms in the cryptoverse (misc and b) tyler perkes. You may refer to this section on how to set up your tax. This form itemizes and reports all commodity. Register your account in crypto.com tax step 2: Select the tax settings you’d like to generate your tax reports. However, many crypto exchanges don’t provide a 1099, leaving you with work to do. Web the recently passed infrastructure act put crypto in the crosshairs, where congress and the irs hope to scoop up enormous tax dollars. Web jan 26, 2022 we’re excited to share that u.s. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. The form has details pertaining to gross proceeds, cost basis, and capital gains and losses.

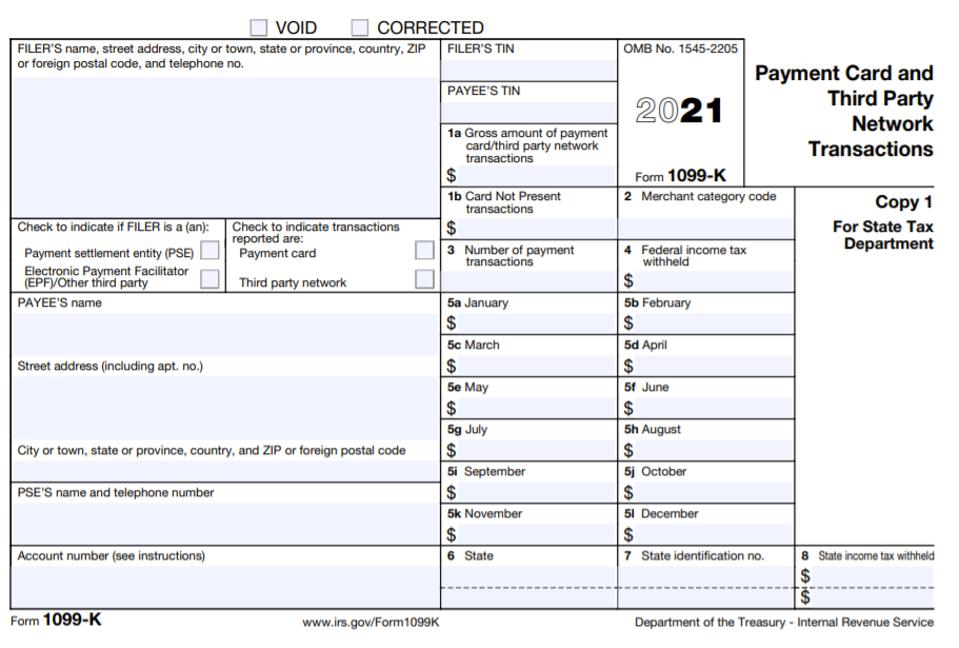

The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. Select the tax settings you’d like to generate your tax reports. Form 1099 is designed to report taxable income to you, the taxpayer, and to the irs. Web definition of digital assets digital assets are broadly defined as any digital representation of value which is recorded on a cryptographically secured distributed ledger or any similar. Web the regulations for 1099 reporting for crypto are still under development. Web for the us taxpayers, the following tax forms/files will be generated for you as well: Web the tax form typically provides all the information you need to fill out form 8949. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. 1099 tax forms come in two flavors: Web the recently passed infrastructure act put crypto in the crosshairs, where congress and the irs hope to scoop up enormous tax dollars.

And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. Web jan 26, 2022 we’re excited to share that u.s. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. However, many crypto exchanges don’t provide a 1099, leaving you with work to do. You may refer to this section on how to set up your tax. 1099 tax forms come in two flavors: Web the infrastructure investment and jobs act of 2021 indicates a 1099 reporting obligation for dispositions of crypto assets under section 6045 of the us internal revenue code. Web definition of digital assets digital assets are broadly defined as any digital representation of value which is recorded on a cryptographically secured distributed ledger or any similar. Select the tax settings you’d like to generate your tax reports. The form has details pertaining to gross proceeds, cost basis, and capital gains and losses.

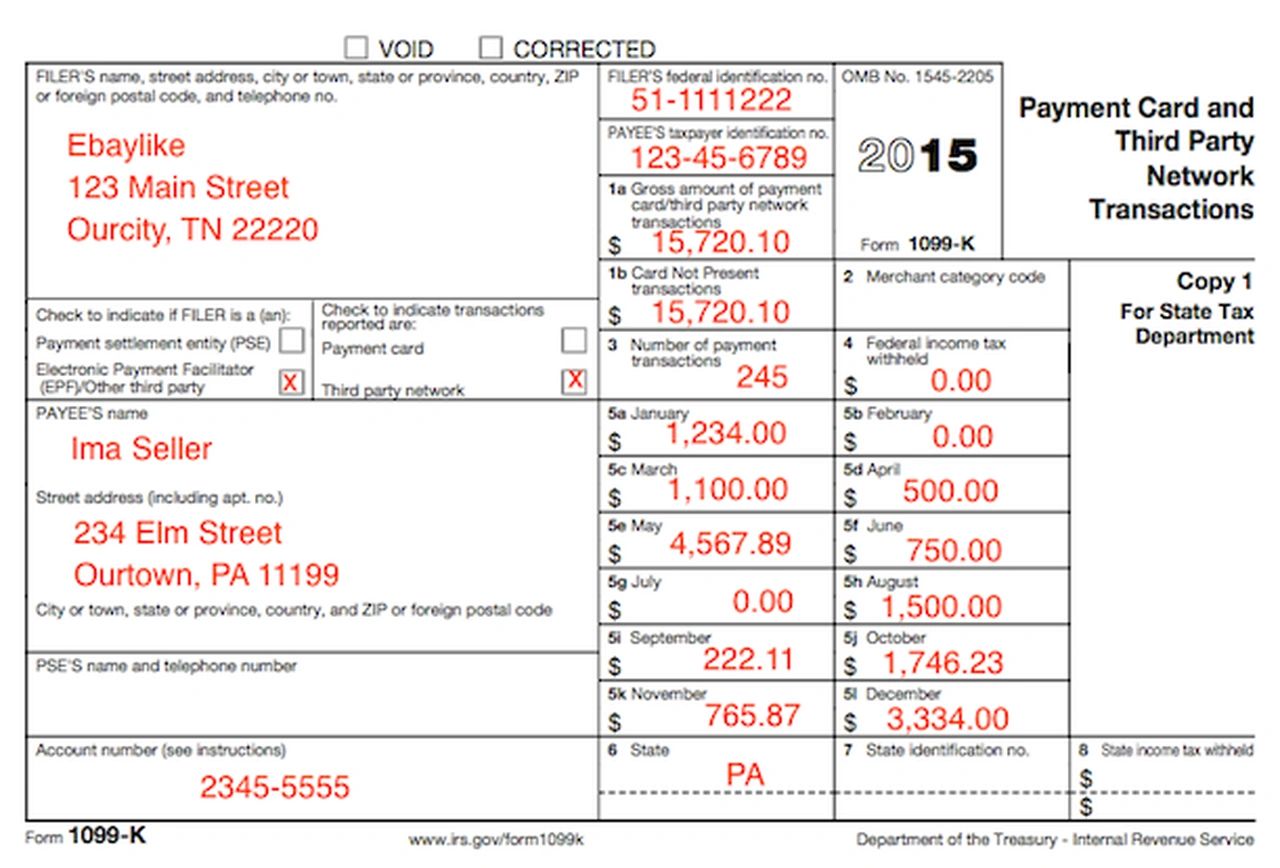

Coinbase 1099 K / What To Do With Your 1099 K For Cryptotaxes Each

However, many crypto exchanges don’t provide a 1099, leaving you with work to do. 1099 tax forms come in two flavors: Web for the us taxpayers, the following tax forms/files will be generated for you as well: Web definition of digital assets digital assets are broadly defined as any digital representation of value which is recorded on a cryptographically secured.

Crypto Tax Advice for Uphold 1099K with Heleum 3/10/18 YouTube

Web jan 26, 2022 we’re excited to share that u.s. However, many crypto exchanges don’t provide a 1099, leaving you with work to do. The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. 1099 tax forms come in two flavors: Web the infrastructure investment and jobs act of 2021 indicates a 1099 reporting obligation.

How To Pick The Best Crypto Tax Software

This form itemizes and reports all commodity. Even if you don’t receive 1099s from. Web 1099 tax forms in the cryptoverse (misc and b) tyler perkes. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. 1099 tax forms come in two flavors:

How Not To Deal With A Bad 1099

Form 1099 is designed to report taxable income to you, the taxpayer, and to the irs. Web the regulations for 1099 reporting for crypto are still under development. You may refer to this section on how to set up your tax. This form itemizes and reports all commodity. Web definition of digital assets digital assets are broadly defined as any.

Don’t Follow 1099Ks To Prepare Your Crypto Taxes

The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. Register your account in crypto.com tax step 2: Web the recently passed infrastructure act put crypto in the crosshairs, where congress and the irs hope to scoop up enormous tax dollars. However, many crypto exchanges don’t provide a 1099, leaving you with work to do..

form 1099 Gary M. Kaplan, C.P.A., P.A.

You may refer to this section on how to set up your tax. However, many crypto exchanges don’t provide a 1099, leaving you with work to do. Even if you don’t receive 1099s from. The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. Web for the us taxpayers, the following tax forms/files will be.

What's Form 1099MISC Used For? Tax attorney, 1099 tax form, Tax forms

Web for the us taxpayers, the following tax forms/files will be generated for you as well: Form 1099 is designed to report taxable income to you, the taxpayer, and to the irs. Even if you don’t receive 1099s from. Web 1 hour agoan unusual alliance of liberal and conservative lawmakers, the irs, and a conservative advocacy group hope their alignment.

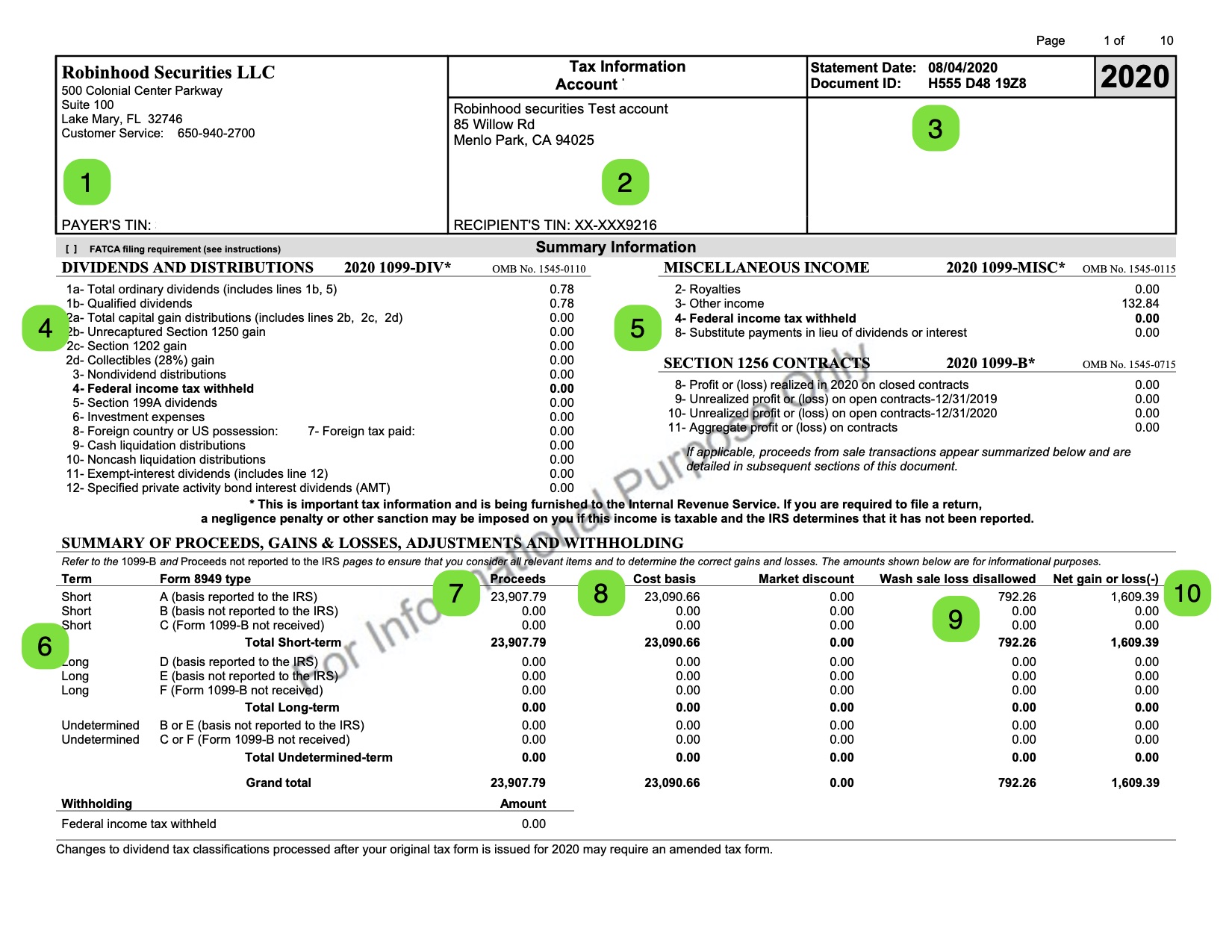

Understanding your 1099 Robinhood

Form 1099 is designed to report taxable income to you, the taxpayer, and to the irs. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. Web the regulations for 1099 reporting for crypto are still under development. Web definition of digital assets digital assets are broadly defined as any digital.

Formulario 1099B Producto de la Definición de Broker y Swap Exchange

And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. Web the regulations for 1099 reporting for crypto are still under development. Select the tax settings you’d like to generate your tax reports. Web the infrastructure investment and jobs act of 2021 indicates a 1099 reporting obligation for dispositions of crypto.

1099 Int Form Bank Of America Universal Network

Web 1099 tax forms in the cryptoverse (misc and b) tyler perkes. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web did you receive a form 1099 from your cryptocurrency exchange or platform? And canada users can now generate their.

Select The Tax Settings You’d Like To Generate Your Tax Reports.

Register your account in crypto.com tax step 2: Web did you receive a form 1099 from your cryptocurrency exchange or platform? The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due.

1099 Tax Forms Come In Two Flavors:

Form 1099 is designed to report taxable income to you, the taxpayer, and to the irs. Web the infrastructure investment and jobs act of 2021 indicates a 1099 reporting obligation for dispositions of crypto assets under section 6045 of the us internal revenue code. Web for the us taxpayers, the following tax forms/files will be generated for you as well: However, many crypto exchanges don’t provide a 1099, leaving you with work to do.

And Canada Users Can Now Generate Their 2021 Crypto Tax Reports On Crypto.com Tax, Which Is Also Available To.

Web the recently passed infrastructure act put crypto in the crosshairs, where congress and the irs hope to scoop up enormous tax dollars. Even if you don’t receive 1099s from. Web definition of digital assets digital assets are broadly defined as any digital representation of value which is recorded on a cryptographically secured distributed ledger or any similar. Web 1 hour agoan unusual alliance of liberal and conservative lawmakers, the irs, and a conservative advocacy group hope their alignment will boost efforts to tweak rules.

Web Jan 26, 2022 We’re Excited To Share That U.s.

Web 1099 tax forms in the cryptoverse (misc and b) tyler perkes. Web the regulations for 1099 reporting for crypto are still under development. This form itemizes and reports all commodity. You may refer to this section on how to set up your tax.